As mentioned in our first article on Formnext 2024, which covered the latest 3D printing technologies unveiled at the show, this year’s event felt a little different to its predecessors.

When I last visited Messe Frankfurt three years ago, there was hype and optimism everywhere you looked, with 3D printing firms raising capital left, right, and center. Fast-forward to 2024 and many traditional headliners arrived in much smaller numbers. Talk of investor interest had also been replaced with a new buzzword: consolidation. But it wasn’t all doom and gloom.

The showfloor remained a hub for innovation, with many exhibitors unveiling technologies that deliver enhanced sustainability and ROI to users within specific industry use cases. There also appeared to be a much larger Chinese presence at this year’s show, reflecting the growing influence of companies like Farsoon and Bambu Lab in the European market.

To get a better understanding of how Formnext has changed over the years and where the 3D printing industry is headed next, 3D Mag reached out to experts across the industry. Let’s take a look at the trends and opportunities identified at this year’s show.

Identifying opportunities for growth

Heading into Formnext, there was a fair amount of negative industry press, but Dayton Horvath, Director of Emerging Technology at AMT-The Association For Manufacturing Technology, sees reason for optimism. Now on his seventh Formnext, Horvath says this year’s event “met expectations” and showed how “more companies are leveraging additive manufacturing to provide products or services targeting specific applications and industry segments.”

In particular, he believes applying 3D printing hardware and software in tandem is allowing a rising number of users “to maximize the value captured” with the technology, everywhere from dental to aerospace. Horvath’s positivity is reflected in the projections of market intelligence firm CONTEXT, which is forecasting a recovery in mid-to-high cost 3D printer shipments in 2025.

Market intelligence firm CONTEXT is forecasting a recovery in mid-to-high cost 3D printer shipments in 2025.

The firm’s forecast is based on a “cautious optimism” being seen among manufacturers, who are experiencing renewed demand, as well as interest rates, which are “beginning to fall.” According to CONTEXT, all this is being underpinned by a rise in the application of 3D printing within high-volume applications, especially in aerospace, automotive, and healthcare.

“As global inflation continues to cool… other segments are also poised to see growth,” explained Chris Connery, CONTEXT’s VP of Global Analysis. “Our forecasts show mid-range shipments are on-track to rise 14% and professional shipments 8%, over 2024. The latter is still lagging, as much of the previous demand for these printers has shifted to entry-level models… whose shipments are still poised for another year of double-digit percentage growth.”

Better meeting customer needs

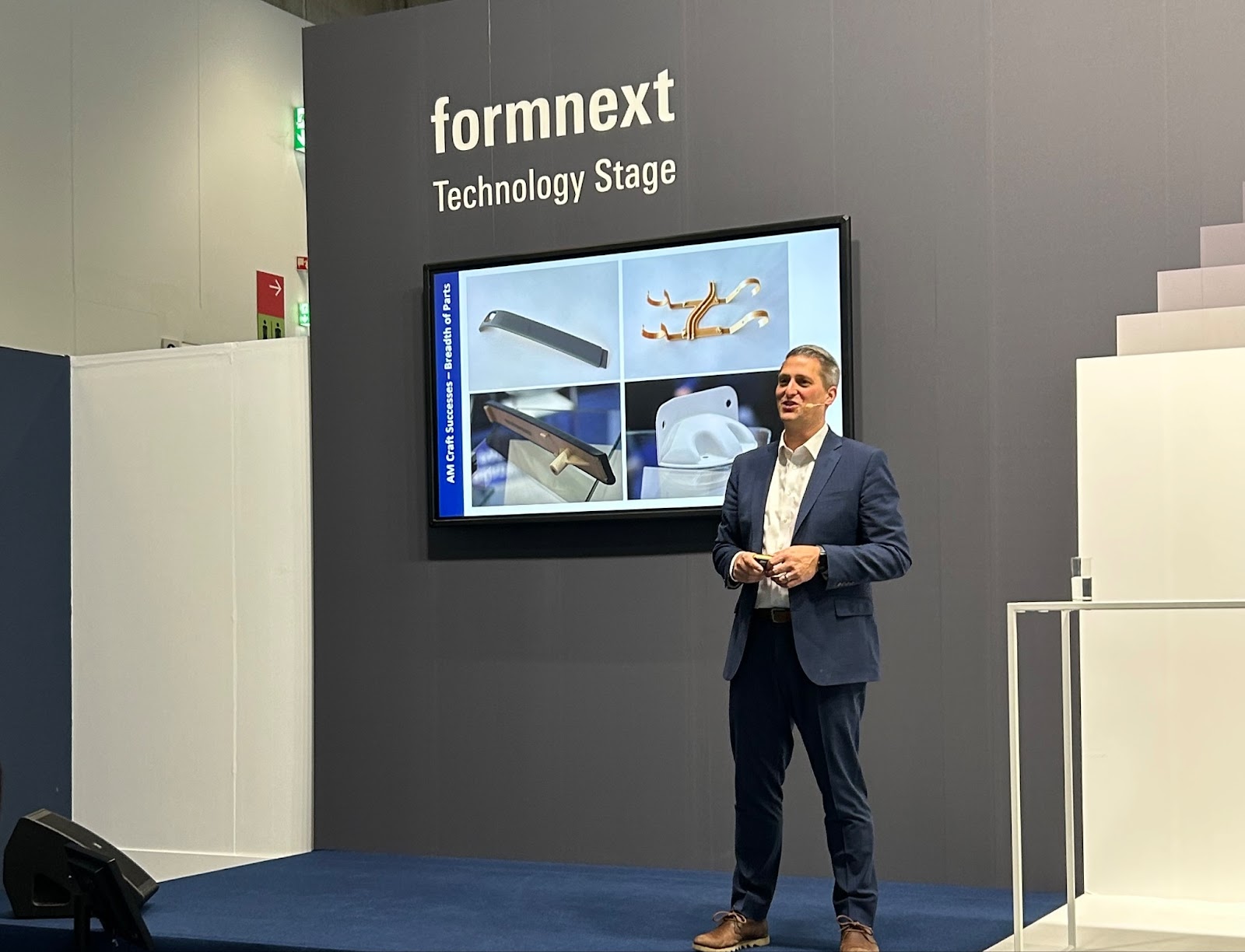

At Formnext, AM Craft’s VP of Strategy & Business Development Scott Sevcik also chimed in on Horvath’s point about better targeting applications and meeting customer demand. As well as highlighting the need for digitization earlier in the aircraft maintenance supply chain, he explained how important it is to “sell to customers exactly what they want to buy.”

By working with OEMs rather than competing with them, Sevcik added that it’s possible to help redesign heritage parts for 3D printing, and establish digital inventories. While it costs more to qualify parts twice, he emphasized that “the upside later on is huge,” with aircraft operators no longer having to get creative with solutions during servicing.

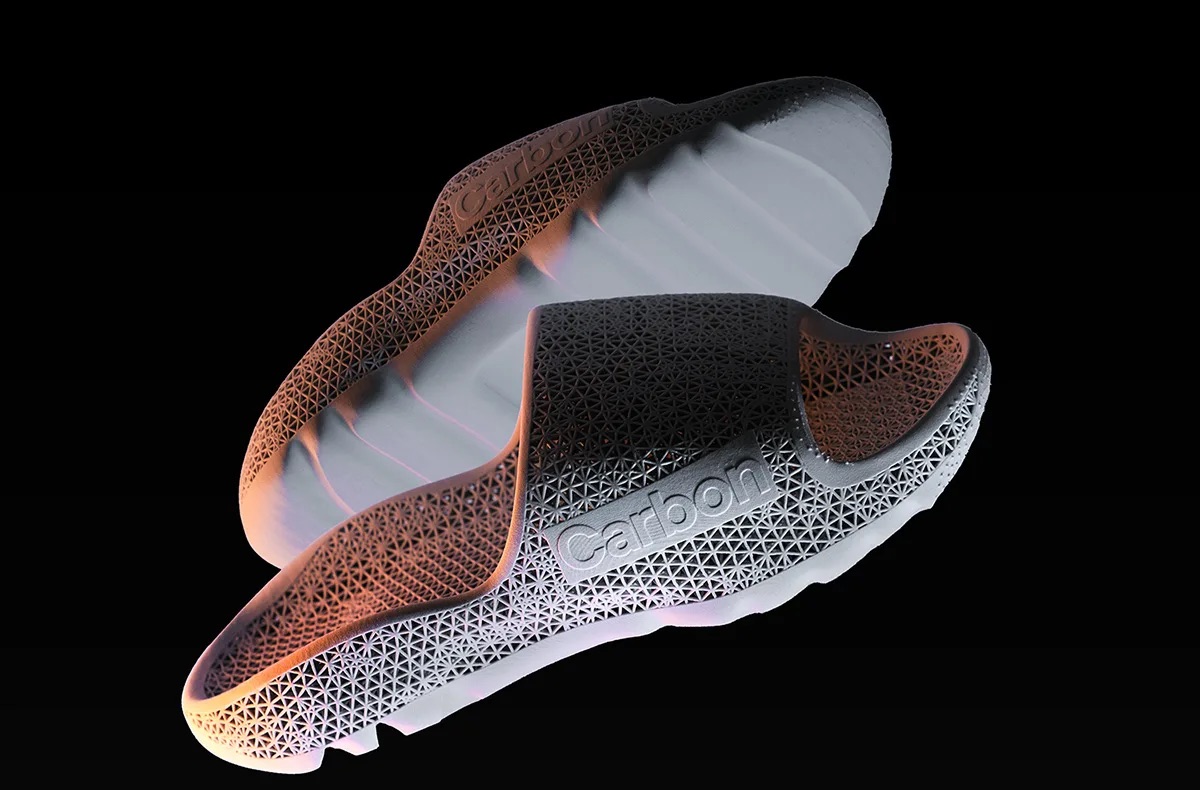

Gary Miller, fellow industry stalwart and Head of European Partner & Market Development at Carbon, shares Sevcik’s drive for close partner collaboration. “They give us inspiration, as much as we give them inspiration. They find applications we haven’t even thought about yet,” Miller said at Formnext. “We share a completely transparent relationship. It’s a true partnership, we are building each other up.”

They [industry partners] give us inspiration, as much as we give them inspiration. They find applications we haven’t even thought about yet.

Carbon is best known for its 3D printed latticed padding, which continues to find applications in professional sport, law enforcement, and more. Miller puts his company’s success in this area down to its willingness “to be industry leaders” and provide physical proof-of-concepts. In future, he anticipates that Carbon’s new single-part EPU Pro resin, which is “lighter, quicker to print, and offers better chemical compatibility,” will only boost its popularity further.

Miller also hails the success of Carbon’s subscription model. Though not entirely unique, he says the concept “is the way forward” as it delivers better value for customers. “Once part yield drops below a certain percentage, they should get a new machine. It’s almost like getting a car on lease, you constantly upgrade. You don’t keep the old one until it’s out of date!”

Incoming: A different kind of consolidation?

Another hot topic of conversation heading into Formnext was market consolidation. With M&A speculation going through the roof in recent months (3D Systems, Stratasys, Nano Dimension, we’re looking at you), there was much talk about how the industry is maturing.

However, if the Formnext showfloor was anything to go by, there seemed to be as many new names and technologies as ever – suggesting that acquired businesses are already being ‘backfilled.’ At the show, the University of Bristol’s Prof. Jennifer Johns gave a fascinating presentation that suggested an alternative theory: a ‘hierarchy of access’ is forming.

If the Formnext showfloor was anything to go by, there seemed to be as many new names and technologies as ever.

Alongside colleague Dr. Roman Barwinski, she explained how research is showing that “politically-driven strategies” are leading to a consolidation of ownership. Recent M&A activity has seen resources concentrated in the US & Israel and it was suggested that this trend could impact access to ancillaries and materials, should it continue.

This is especially relevant considering the growing influence of Chinese 3D printer manufacturers on European soil. AMT’s analysis showed that just under half of China-based exhibitors were first timers and Horvath “expects to see this trend to continue next year.”

But growing Chinese interest needn’t be seen as a negative. Horvath says they’re simply “investing in growth by targeting the European market.” Industry veteran and now President of Americas & Asian Pacific at Anisoprint, Tuan Tranpham, also believes newcomers “aren’t just being copycats, they’re bringing new innovations” and fresh opportunities for expansion into the Asian market.

What next for the 3D printing industry?

While our industry insiders each have their own hot takes, they all seem to agree on one thing: 3D printing remains a hotbed of innovation. Whether it be in desktop machines, huge, high-end systems, or emerging markets in Asia, they all see opportunities for growth.

Then, there’s Formnext itself. In the words of Tranpham, “the show is now more inclusive. It’s about more than just 3D printing, it’s robotics, automation, and post-processing.” In light of this expansion – and the industry’s accelerating recovery from a COVID-19 slump – it seems more likely than ever that Formnext will continue to grow and evolve for years to come.

So, what next for 3D printing? Judging by our experts’ contributions, further Asian involvement in the European market, greater application focus, and plenty more innovation is on its way, for an industry still finding fresh opportunities in the most lucrative verticals.

Thanks for following our Formnext feature series. This feature rounds off our coverage, but feel free to catch up here, and subscribe to our LinkedIn for all the latest news with 3D Mag.